- Home

- Campervan Insurance

- 80 years drivers

|

Why Use Us? SECURE & ENCRYPTED

HAPPY RETURNING CUSTOMERS

100% FREE COMPARISON SERVICE

YOU COULD SAVE TIME & MONEY

|

Why Use Us?

Secure & Encrypted Form Data

UKLI COMPARE guarantee your confidence by securing online forms by following the latest internet security standards.

Happy Returning Customers

At UKLI COMPARE, we've thousands of happy customers returning to find great deals - since 2011.

100% Free Comparison Service

Using the services here on our website is always free to the consumer 100%.

You Could Save Time and Money

Get your quotes by filling in one simple form, compare prices, and start saving.

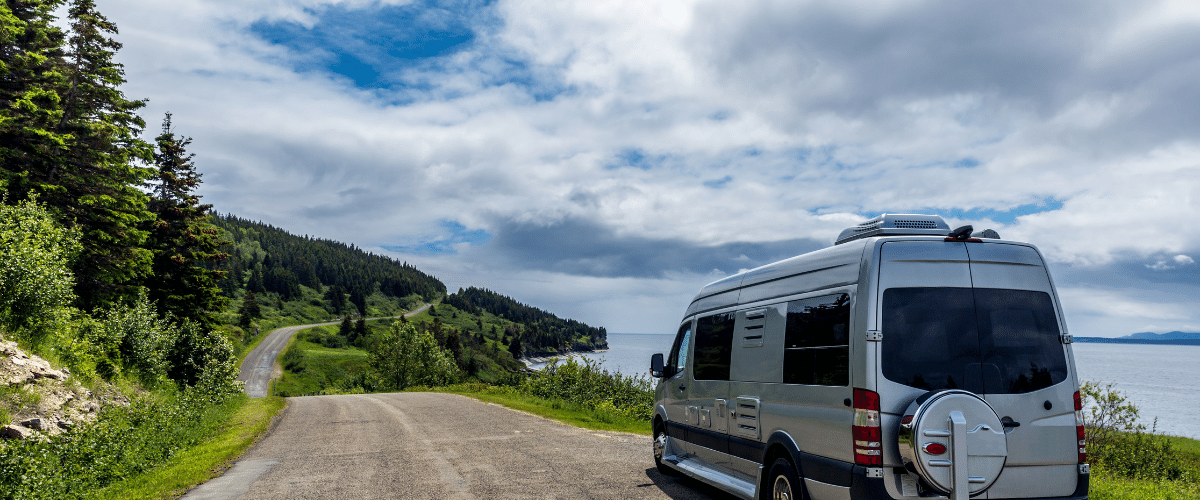

Campervan Insurance for Over 80 Years Old

You are in the right place for great campervan insurance for over 80 years old drivers. In fact an excellent place. If you want a quick quote (Click Here), but if you want more information on camper insurance - read our guide.

Compare quotes from the UK's leading camper insurance for a great start.

Since you 80 years old (and well done reaching your 80th) your insurance will still cost a few hundred pounds every year. If you know how much you pay and you are not worried about where you get you a policy, any insurance company will consider you as a customer.

Before you get a price today you can read on…

There are several things that you need to know when buying van insurance that can significantly lower the rate of the policy. For instance, did you know that large vans can cost you considerably more to insure than small vans? This piece of information can prove valuable if you are in the market for a new van for personal or commercial use.

Campervan Insurance for Over 80 Years Old drivers

As a matter of fact, you can save a bundle by choosing the right type of vehicle but since you are 80 and over you don’t have much to worry about here. There are several other such secrets revealed below that can help you to cut the cost of insurance, so read on.

The type of vehicle you own will impact insurance rates

Big vehicles are difficult to manoeuvre and prone to accidents that cause a significant amount of damage, so it is only natural that buying coverage for a large vehicle will cost you more than if you were to purchase a policy for a small van.

The make and model of the vehicle and the safety features in it will also make a huge difference to your premiums. Apart from this, the type and nature of cargo that you intend to haul in the van will also have a bearing on how much you end up paying for the policy.

The age of the driver (for you, it’s 80)

The age of the operator is also a determining factor for insurance providers; after all, the safety record of a vehicle will prove to be futile if the driver has a penchant for unsafe driving. Generally, drivers over the age of 25 will get insurance at a lower rate than drivers below that age.

While you cannot directly control this factor, there is a way to influence it by adding more than one driver to the policy. Make sure that 2 out of 3 drivers are in their thirties with ample of experience operating the type of vehicle that you want to insure and with a clean driving record.

The area that you live in or work out of

The city and the area in which you live or work out of will also impact the rate of insurance. If the van is kept in a locality with a low crime rate, the chances of theft and related damage are reduced and this will reflect in your premiums. On the other hand, residing in an area with a high auto theft record will raise the price tag on auto insurance for you.

A misconception about camper insurance

Contrary to popular belief, camper insurance does not cost more than a personal vehicle policy. However, because expensive goods may be transported in a commercial van, the amount of coverage needed is higher which raises the rate of insurance. The route on which the vehicle is used and how much it is driven will also affect the premiums.

The simplest trick to reduce van insurance costs

The simplest trick to reducing the rate of insurance is to put a sticker on your vehicle with your business logo on it. If the van will be used for personal purposes, simply add a sticker that tells people to call on a certain number if they find the van being driven unsafely. Using your business logo on the vehicle will tell the insurance provider that you consider the vehicle to be an important part of your venture, so it will be treated with respect and care.

When trying to influence the rate of auto coverage, use a combination of the various techniques mentioned above. Try to understand how you can change the factors in your control and how doing so will impact the rate of over 80 campervan insurance.

Compare campervan insurance for over 80 years old drivers and find a decent policy and price.

Go to the motorhome insurance and campervan insurance homepage.

Return to the main campervan insurance homepage.

campervan Insurance Comparison

Hit us up on Social media

Recent Articles

-

Home Solar Panels Scotland - Get Quotes From Local MCS Installers

Apr 15, 25 05:04 PM

Approved MCS home solar panels Scotland. Get the right installers on the job the first time around. -

HOME-SOLAR-TEMPLATE

Apr 15, 25 03:41 PM

HOME-SOLAR-TEMPLATE -

Solar Panel Installation | Home & Commercial Installs | UKLI Compare

Apr 15, 25 01:10 PM

Compare solar panel installation quotes and get the best possible price and quality installation practices with the right installers you can count on and... -

Compare Office Surgery Insurance Quotes Online | UKLI Compare

Apr 14, 25 01:15 PM

Cover your surgery with office surgery insurance and compare quotes to find the perfect policy for your surgery fast. -

Private Landlord Insurance for Private Tenants | UKLI Compare

Apr 14, 25 12:31 PM

Compare private landlord insurance quotes and find better prices in no time and get your tenants sorted with the right insurance from day one. If you know... -

Landlord insurance | Housing Benefit? | UKLI Compare

Apr 14, 25 11:58 AM

Need to know more about tenants who claim housing benefits or insuring them, it's all here landlords. -

Landlord Insurance for a Limited Company | UKLI Compare

Apr 14, 25 11:31 AM

Do you need landlord insurance for a limited company? Take the hassle out of getting quotes and talking to unnecessary insurance companies a service that works -

Compare landlord contents insurance quotes, fast | UKLI Compare

Apr 14, 25 11:01 AM

Compare the market for landlord contents insurance and find great online prices you'll be happy with. Works perfectly for UK landlords. -

Part-Time Motor Trade Insurance Comparison | UKLI Compare

Apr 14, 25 10:18 AM

Compare part-time motor trade insurance quotes and see the difference in price when you use a good comparison website like UKLI Compare. -

7.5 Tonne Motorhome Insurance | Compare Quotes | UKLI Compare

Apr 14, 25 10:00 AM

Compare 7.5 tonne motorhome insurance quotes and walk away with a good policy for a decent monthly or annual price. -

VW Campervan Insurance & Motorhome Comparison | UKLI Compare

Apr 14, 25 09:40 AM

If you are looking for VW campervan insurance or a VW motorhome policy for your transporter or your T25 or a classic T1 or T2 you can do it here. -

Compare Cheap Campervan Insurance Quotes Online | UKLI Compare

Apr 14, 25 09:38 AM

Compare cheap campervan insurance from specialist campervan insurance companies and win a good price. -

Campervan Insurance with Breakdown Cover | UKLI Compare

Apr 14, 25 09:33 AM

Compare campervan insurance with breakdown cover and get the policy your looking for in a snap campers. -

Need 6 Month Campervan Insurance - UKLI Compare.co.uk

Apr 14, 25 09:31 AM

Get the help you need when looking for 6 month campervan insurance and make sure the vehicle has the protection it needs for one driver or multiple drivers. -

Best Motorhome Insurance Quotes Online | UKLI Compare

Apr 14, 25 09:11 AM

Compare the best motorhome insurance quotes from Britain's leading insurers and you could save a lot of time and money today. -

2 Van Fleet Insurance | UKLI Compare

Apr 14, 25 08:44 AM

Get a good price on 2 van fleet insurance for your business and keep it running with a good policy you can count on. -

Nursery Minibus Insurance | Keep Your Children Safe | UKLI Compare

Apr 14, 25 08:26 AM

Compare nursery minibus insurance quotes with great insurance companies with a fast and secure form that works with the UK's top minibus insurers. -

Minibus Insurance for 1 Week | Get a Fast Quote | UKLI Compare

Apr 14, 25 08:19 AM

Get minibus insurance for 1 week for your planned trip for pleasure or business and make sure you save on a policy from the first quote you get. -

Any Driver Minibus Insurance | Get Online Quotes | UKLI Compare

Apr 14, 25 08:17 AM

Compare quotes and get the right price on any driver minibus insurance with an experienced company. -

Minibus Hire Excess Waiver Insurance - UKLI Compare

Apr 14, 25 08:16 AM

Get minibus hire excess waiver insurance so no matter what happens you have the right cover for your hired minibus. -

Minibus Sports Club Insurance | Compare Quotes & Win | UKLI Compare

Apr 14, 25 08:15 AM

Compare minibus sports club insurance for sport clubs like football clubs, boxing, rugby, golf and cricket clubs who need insurance for their minibus for sports days. -

9 Seater Minibus Insurance | Comparison & Quotes | UKLI Compare

Apr 14, 25 08:13 AM

Compare 9 seater minibus insurance for your minibus business of if you use it for private hire that's fine as you can get good quotes... -

8 Seater Minibus Insurance | Get Quotes Now | UKLI Compare

Apr 14, 25 08:09 AM

Get quotes on your 8 seater minibus insurance whether it be for annual or short-term cover you can find a good comparison here. -

Private HGV Insurance Quotes | UKLI Compare

Apr 14, 25 07:37 AM

When you want private HGV insurance and not for business use you can relay on the team of insurance professionals to help you along the way. -

HGV Insurance for 18 Year Olds | Compare Quotes | UKLI Compare

Apr 14, 25 07:35 AM

If you are looking for HGV insurance for 18 year olds it might be a difficult if you don't ask the company. Compare quotes and find out... -

HGV Goods in Transit Insurance | UKLI Compare

Apr 14, 25 07:33 AM

Get ready to compare HGV goods in transit insurance quotes from the top truck insurance companies in the UK and do it quickly. -

HGV Fleet Insurance Quotes | UKLI Compare

Apr 14, 25 07:32 AM

HGV drivers and business owners compare HGV fleet insurance from the UK's top rated insurers in one swift go. -

Compare HGV Insurance Quotes & Fast | UKLI Compare

Apr 14, 25 07:26 AM

Compare HGV insurance quotes and get prices from the UK's leading HGV insurers for an excellent policy. Goods in transit insurance is available too. -

Compare Landlord Insurance Quotes - Save Time & Money | UKLI Compare

Apr 14, 25 07:11 AM

Compare landlord insurance quotes and adequately cover your assets with buildings and contents insurance, or add extra landlord protection. -

Short Term HGV Insurance | Temporary HGV Insurance | UKLI Compare

Apr 13, 25 05:22 PM

Do you need short term HGV insurance for a week and a month or even shorter periods? Compare quotes, and you could get cheaper temporary HGV insurance.